Serving as a Backbone to Washington’s Economy: The Global Trade and Supply Chain Management Sector

The global trade and supply chain management sector is a mainstay of Washington state’s economy. Now thanks to an economic analysis conducted for the Center of Excellence by Community Attributes, we know just how large it is, the average wage in various subsectors and where the jobs are congregated.

Washington state is one of the most trade dependent states in the nation. According to U.S. Customs data, in 2017, more than $77.0 billion in merchandise and commodities originating in Washington were exported to overseas markets. These exports included not just airplanes, but also medical devices, agriculture commodities, machined parts, processed foods and many other Washington-made products. Washington’s ports, led by the Northwest Seaport Alliance and non-containerized operations at the ports of Seattle, Tacoma, Grays Harbor and Everett, and air cargo out of Sea-Tac International Airport are also key purveyors of trade between other parts of the U.S. and the world. These ports facilitated the movement of $80.2 billion in exports and more than $92.0 billion in imports in 2017, including products from or destined to domestic markets as far as the U.S. Midwest, making this region one of the most important centers for containerized, bulk and breakbulk shipments in the country.

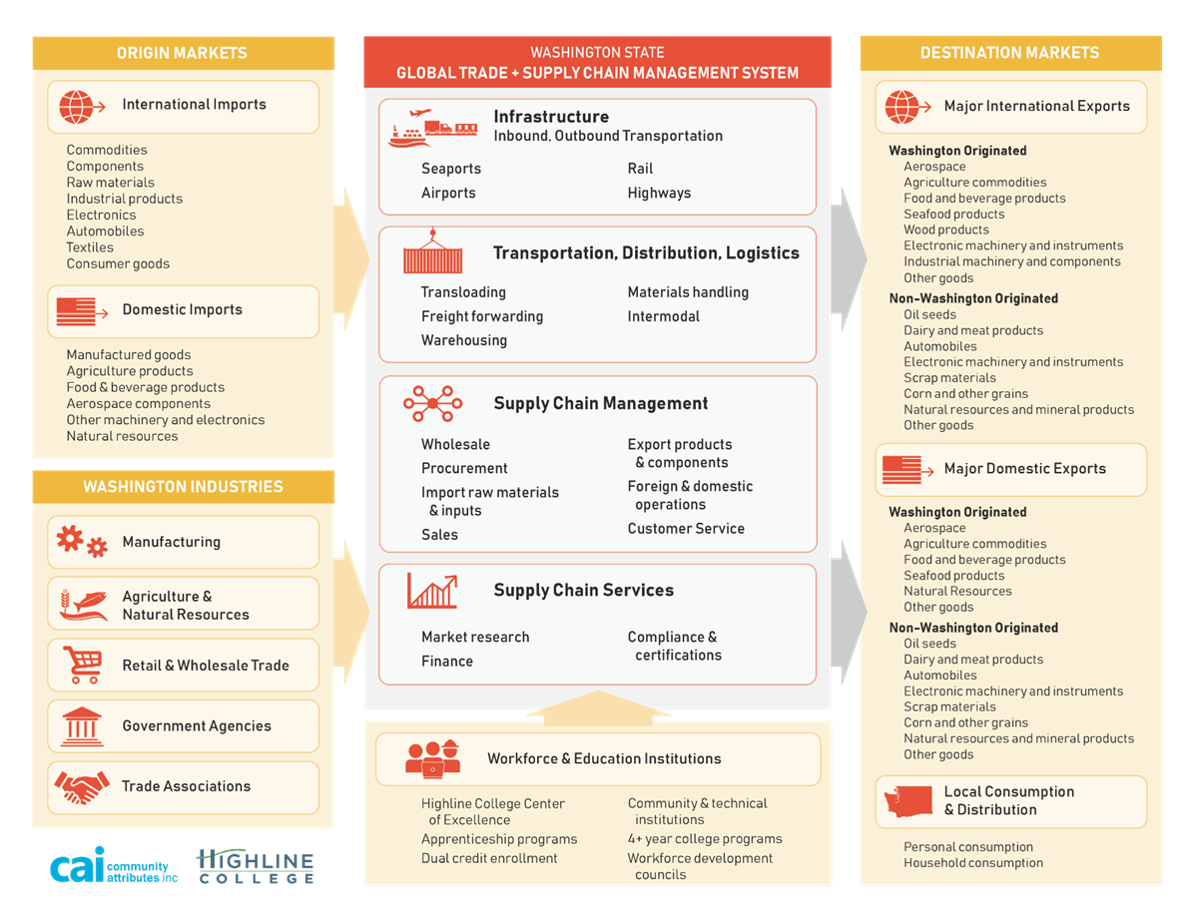

Behind these large trade flows exists an extensive network of service providers and logistics operations that comprise the Global Trade and Supply Chain Management (GTSCM) sector. These include companies and organizations specializing in marine terminal operations, air freight shipments, supply chain management, freight forwarders, trade finance and trucking, compliance services, as well as the ports, educational institutions, and state and federal government agencies. In addition, there are many related operations and personnel within trade-reliant industries in Washington, such as global logistics and supply chain managers at The Boeing Company and within e-commerce operations.

The GTSCM sector is a significant source of employment and economic activity in our state. In 2017, this sector directly employed an estimated 157,000 workers. These include workers in businesses primarily engaged in GTSCM activities, such as freight forwarders, plus many additional supply chain management and logistics positions within businesses that rely on these functions, such as amongst manufacturers, wholesalers, and e-commerce operations. Combined, these activities further supported more than $12.3 in labor compensation and $35 billion in business output.

Factoring in broader multiplier effects from upstream business-to-business transactions and worker household income expenditures on goods and services, the businesses primarily engaged in GTSCM had a total economic impact of 192,500 jobs. Added to this, activities among other industries, such as e-commerce and aerospace, further supported a total impact of 170,600, yielding a total combined impact of 363,100 jobs across the state economy.

Interviews with private and public sector stakeholders highlighted several key strategies for further supporting growth of the sector. Businesses emphasized the need to continue to invest in curriculum and training in the use of new technology tools, such as the skills needed to work with big data and analytics and various warehouse, transportation, and yard management systems. Stakeholders encouraged the further development of internships and apprenticeship programs, efforts to increase the pipeline of truck drivers, and the inclusion of soft skills, such as the development of cultural sensitivities and awareness needed when working with foreign suppliers, in training programs. Curriculum development efforts should also focus on all industries of the economy—according to educational stakeholders, the majority of graduates from supply chain management programs find employment among manufacturers, e-commerce firms and other businesses that depend on extensive supply chains. Lastly, stakeholders emphasized the growing workforce needs in warehousing and freight forwarding.

Provided by: Spencer Cohen and Chris Mefford, Community Attributes